Give Securities

Give Hope with a Gift of Securities

By donating mutual funds, stocks and other securities, you will save on taxes - resulting in a more generous gift. And a greater gift means more lives transformed with the Hope of Jesus.

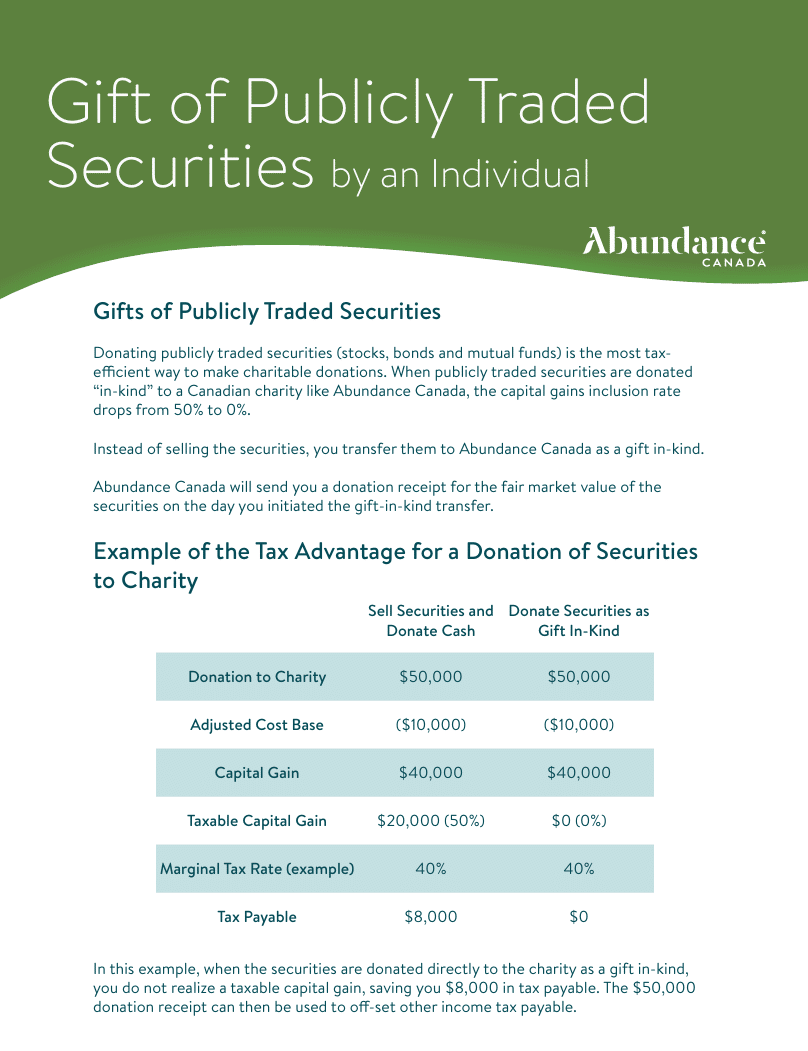

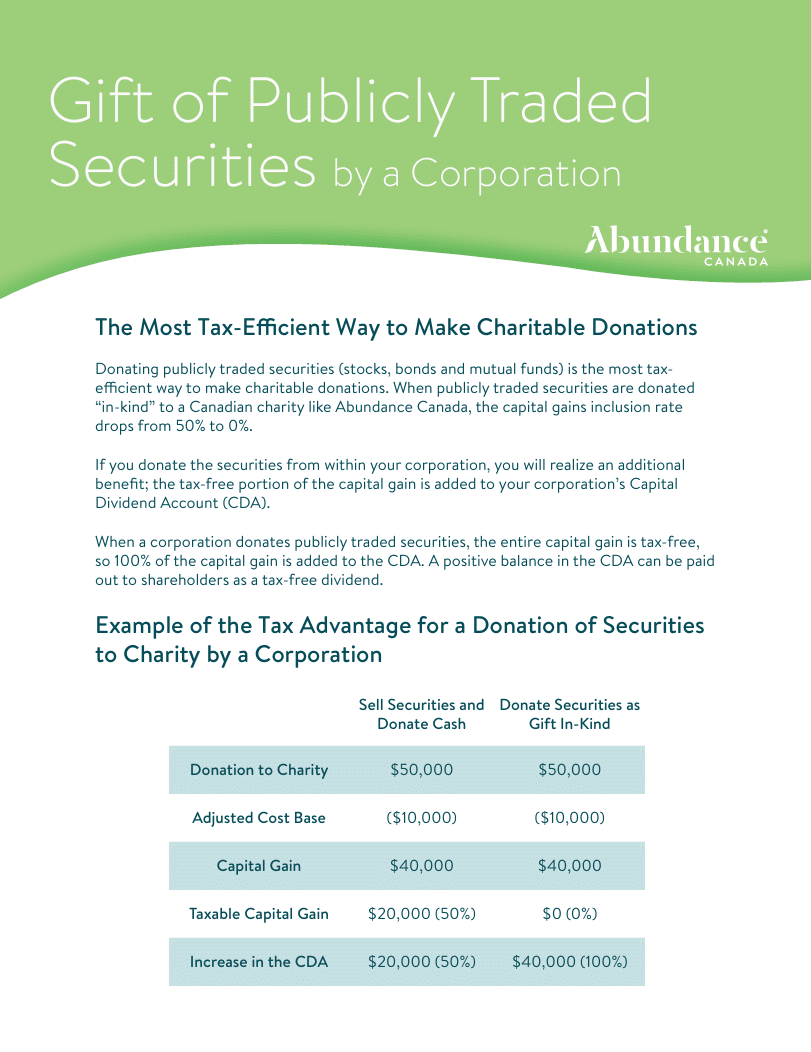

Why Give Securities?

When you donate securities you eliminate the capital gains tax that you’d have to pay if you sold the securities and then donated the proceeds. You will also receive a tax receipt for the full donation. This means your donation costs you less but does so much more!

Making Generosity Simple

To help navigate this process we recommend working with Abundance Canada. With over 47 years experience, Abundance Canada will help you with every step. From how to instruct your broker, to selling the shares, providing the tax receipt and transferring the funds to UCB Radio.

Resources

UCB Radio Fundraising Statement

In 2025, United Christian Broadcasters Media Canada (UCB) aims to raise $3,084,000 in total donation revenue to support our ministry, Ignite Hope across Canada through Christian music radio. Approximately, 8% of funds will be allocated to fundraising and 8% to administration. UCB is a federally regulated charity, incorporated in Belleville, Ontario.

For more information or to request a copy of our latest audited financial statements, please visit our website at Financial Statements or contact us at finance@ucbmedia.ca.

If contributions received by UCB exceed the fundraising goal, or if project goals become unachievable as determined by the UCB Board, it reserves the right to allocate funds to similar projects, objectives, or programs in pursuit of UCB's mission, as reasonably determined by the UCB Board.

Restricted Giving Policy

Spending of funds is confined to programs and projects approved by the organization. Should a donor choose to restrict a contribution for use in a particular program or project, we will honour that restriction, with the understanding that, when the need for such a program or project has been met, or cannot be completed for any reason as determined by the organization, the remaining restricted contributions will be used where most needed. Gifts are acknowledged and receipted with an official receipt for income tax purposes.

Uplift Your Day with the Free UCB App

Get encouraging music, devotionals, podcasts, and more—right at your fingertips. Try the 30-Day Listening Challenge and see the difference it makes.

Enjoy a Brighter Day with UCB Radio!

Listen Every Day

Join the Community

Share the Mission